Bear Market Call on Target: What's Next?

All major indexes closed 20% down from previous highs in record time.

It took just a few days of consistent plunges for all three major market indexes to redeem my bear market call. All declined 20% or more from their previous highs in just a matter of days from my prescient market call on this platform.

What’s next?

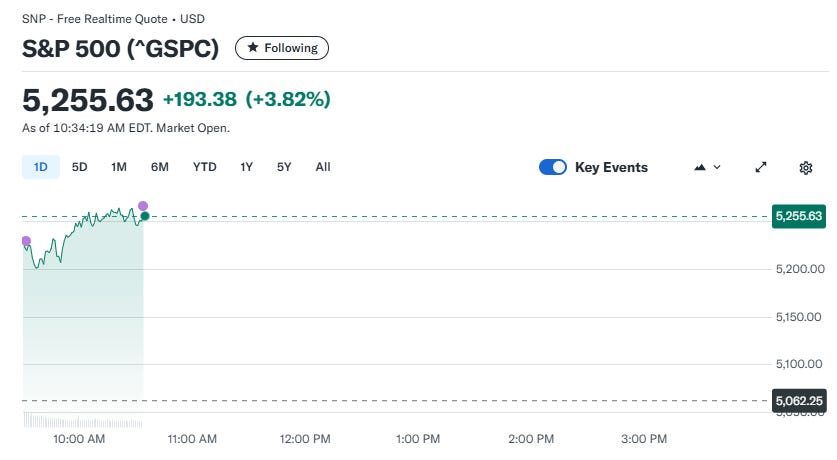

Today’s futures showed each of these indexes jumping 2.5% to 3% before the market open. As I write this, we are see a big technical bounce from the lows. The S&P 500 and the Dow Jones Industrials are ahead more than 3.5% and the other indexes are doing the same.

Hope Springs Eternal

All major economists from all respected institutions agree with my analysis. There are no winners in a trade war. It is evident from the cataclysmic market reaction the last few days, traders and investors alike agree as well.

Only a brief visit to the Smoot Hawley tariffs of the 1930’s would let even the casual observer understand, tariffs are disastrous for world trade and consume pocketbooks.

Today’s technical bounce from the lows are based on the hopes that “more than 50 countries have called” the president seeking to negotiate these ruinous tariffs. Japan has been praised by the secretary of the treasury for engaging in talks with the president. Israel’s prime minister, Netanyahu made his bid yesterday. Vietnam offered to lower their tariffs to zero.

If solid progress can be demonstrated, even with just a few countries, President Trump will be able to declare victory and the markets, worldwide, will breathe a sigh of relief. Markets want nothing more than a return to normal, just assessing company profits and earnings and making prognostications on those alone.

Time Will Tell

We’ll know at the close of trading today whether this positive move can hold and give us an indication that we’re out of the woods. However, if we once again swoon before the days is done, we’ll know that we have more pain to endure before this bear is done mauling our portfolios.

Subscribers to the Retirement: One Dividend At A Time investment newsletter who mirror the RODAT Portfolio have annual income in excess of $138,000.00 from dividends alone.

I don’t have investors or work for a large corporation. My work is fueled by people like you. If you enjoyed this article, would you consider supporting me?

Other articles with over 80,000 views each that readers found worthwhile reading:

Turn $20,000 in Savings into $1000 a Month in Passive Income

It’s easier than you might think to generate $1,000 a month from just $20,000.medium.com

The Coming Bear Market/Recession Can Save Your Retirement

All it takes is a life-changing shift of perspective to understand: A bear market and a recession could save your…medium.com

Here’s What Warren Buffett is Doing as the US Stock Market Plunges

Buffett’s actions may seem counter-intuitive to new investors: More experienced investors get itmedium.com

Eroxon Beats Viagra Hands Down

Beating off and intimate sex has just gotten way easier and faster.medium.com

Best,

George Schneider, M.A

Editor and publisher, Retirement: One Dividend At A Time

Visit my Substack for more in-depth analysis and stock dividend recommendations, here:

https://rodat1.substack.com/subscribe

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2025, George Schneider

Thanks, Alexa. Glad you enjoyed this post. I hope you'll consider subscribing for more actionable articles like this.

https://rodat1.substack.com/subscribe