Double Your Money in the Market, Over and Over Again

Don't take my word for it; just follow this easy math.

Albert Einstein, Source: Google Images

The reaction people give never disappoints. But demonstrating the rapid growth of dollars is more than just a parlor trick. It’s one of the most important concepts that investors need to learn — the younger they are when they learn it, the better. The sooner they put it into action, even better.

In a typical public school curriculum, children are taught adding, subtracting, multiplying, division, geometry, trigonometry, fractions, decimals and algebra. Even in the best private schools, this is still the case. Investing and the practical application of investing principles is a much-ignored topic. Forget about compounding of returns.

But when I show them how money can double in an investment, again and again during the course of their lives, they’re still blown away. Some don’t believe it till I give them several examples.

Especially when I explain that time is a better friend to the investor than experience, connections, expertise, or even research. It’s even better than all those stock tips investors love to share at cocktail parties, especially at times like this when the market is so frothy and so much of it is overvalued.

And yet so few people seem to have a good grasp of the power of compounding. So I come back repeatedly to this essential topic to spread the word. Like good advertising, the more the message is repeated, the more it gets absorbed. The better impression it makes, the greater the possibility that this concept gets deployed by readers in order to enhance their investment returns in real terms.

This repetition is part of behavioral investing 101. As a retired clinical psychologist who employed these methods successfully for decades with my patients, then with investors, it makes perfect sense to also share it with readers so they can be the judge of this, themselves.

And Away We Go…

The growth rate of the S&P 500 index over the last 75 years has been demonstrated at about 10% per year. So, if we can find an investment that pays us a dividend of 10% or more, year after year, we will have achieved the same growth rate of the S&P.

However, if that same stock also achieves a 10% growth in the price of its stock, then we can comfortably double the return of the S&P 500 index itself, coming out with a 20% yearly return on our investment from the combination of stock price growth plus dividend distributions. This is otherwise referred to as total return.

Compound Calculator

The easy calculation estimator commonly used to determine how many years it takes for an investment, or dividend income accumulation to double, is the rule of 72.

For instance, if an investment grows at 10% annually on a long term basis it should double in price in about 7.2 years:

72/ 10 = 7.2 years

Here’s a compound calculator that is available on line that you can use for free and apply your own inputs.

As you can see from the above, a stock, or any investment paying a 10% dividend with no further contribution other than the initial $1000.00 investment, will grow to $1986.22 with no further effort from the investor in just 7.2 years, as shown on the graph.

With stock prices, it’s important to remember, the ups and downs of the market make such a return lumpy. Some years you’ll see a 10% stock price increase, some years a 20% increase, and other years perhaps a 10% decline. That’s why it’s referred to as lumpy.

Smooth Out the Return with a Stable Dividend Payout

One way to smooth out the lumps is to buy a stock that has demonstrated a consistent, high and reliable dividend payout to its investors.

One such company we’ll use to demonstrate this principle is Abdrn World HealthCare Fund (THW).

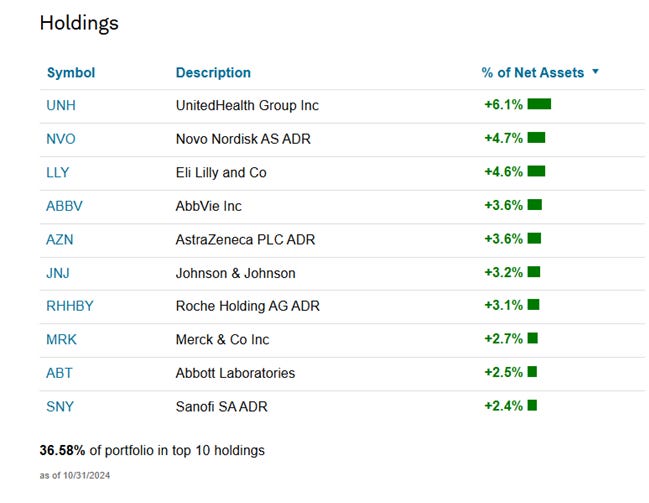

“Tekla World Healthcare Fund is a closed-ended balanced mutual fund launched and managed by Tekla Capital Management LLC. The fund invests in public equity and fixed income markets across the globe. It seeks to invest in stocks of companies operating in the healthcare sector. For its fixed income portion, the fund primarily invests in corporate debt securities. Tekla World Healthcare Fund was formed on June 26, 2015 and is domiciled in the United States.”

Source: Yahoo Finance

From the above chart, you can see that it currently pays out a very juicy 12.31% dividend to shareholders at current prices. This dividend is paid out monthly which gives greater flexibility to investors who need regular income to pay bills in retirement.

For younger investors, the steady monthly payout presents the opportunity to reinvest dividends monthly in the same company, or others that the investor thinks may be more worthy of their investment dollars.

The above chart shows only the last 4 quarterly payouts. Take at look at this:

I’m not going to bore you any further. You’ll have to trust me on this, or go to Yahoo Finance and see for yourself. This company has been paying the same, high monthly dividend payment of $.12 since February 17, 2016 (it’s actually $.1167, rounded by Yahoo to $.12). That’s nine years of consistent payouts that investors have been able to count on.

The hat trick here is to buy THW on market sell-offs, such as what we’ve witnessed in the last couple of weeks..

I recommended this company to our hundreds of paid subscribers a couple of weeks ago at $10.92 per share. Since the annual dividend distribution comes to $1.40, the accidentally high yield our investors managed to secure was:

$1.40/$10.92= 12.82%

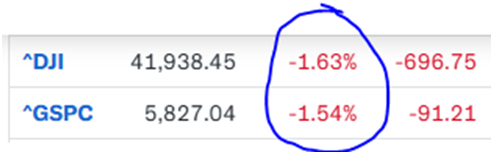

Since we bought at that level, the stock has risen to $11.46 as of Monday’s trading, even as the market has sold off. In fact, on Friday, January 10, the stock fell only .44% while the S&P 500 fell 1.54% and the Dow Jones got pounded even harder, down 1.63%.

Market Update

source: Yahoo Finance

As of 1/28/25, the stock is now ahead $1.06 or 9.7% higher than what we paid for it just weeks ago, handing each and every one of our subscribers who bought this recommended position a capital gain of $2120.00 plus $233.33 in dividends paid last week, for at total return so far of 2,353.33.

Why Did the Market Sell Off So Hard?

Market participants were expecting the labor department to report a further fall in new jobs created the past week. Instead, they reported a very big uptick in new jobs. While this good news painted a picture of a strengthening economy, it presented a conundrum to investors. A stronger economy means the Federal Reserve will have no incentive to cut interest rates this month. What’s more, investors began to bet that rates might not decline for another year. So, good news was once again bad news for investors.

Since cheap money is what drives a company’s ability to invest and expand, a tightening monetary policy presents the market with an opposition conclusion.

When we contrast THW’s performance Friday to the broad market’s sell-off, we must conclude that market participants understand that an aging population continues to age and expand as more and more baby boomers age out of the work economy. This expanding population translates to greater and greater opportunity to the health care companies that THW is invested in.

Greater revenues and profits for these major health companies, most of which are household names, mean those companies will have no problems paying their bond interest to THW. And because THW leverages their investments in these bonds, investors are able to profit handsomely from enhanced dividend distributions.

And, by the way, even a weakening economy presents little threat to the very large pharma companies that THW invests in. In a strong economy or weak economy, like food, all people need the products and medications these companies produce. Consistent demand for their wares translates to continual growth of revenue and profits.

Double Your Money, Over and Over Again

Using the rule of 72, we saw a 10% dividend distribution double an investors’ capital in 7.2 years. When we apply this same rule to an investment yielding 12.88%, it takes just 5.6 years for the investor to double her investment.

72/12.88= 5.6 years

When prices are depressed and the dividend distribution remains the same, this is the time for investors to take advantage of an accidentally high yield. Only buying at lower prices makes it possible to double one’s money in less than 6 year’s time. Do this when you’re first starting out in the workforce at age 21, and by the time you’re thinking of retiring at age 65, you’ll have doubled your initial investment 7.84 times.

44 years of work/ 5.6 years = 7.86 doublings

Invest $5000 just one time, for 8 doublings:

After 1st doubling : $10,000

After 2nd doubling: $20,000

After 3rd doubling: $40,000

After 4th doubling: $80,000

After 5th doubling: $160,000

After 6th doubling: $320,000

After 7th doubling: $640,000

After the 8th doubling: $1,280,000 (that’s way more than a million bucks!)

Conclusion

Wow! No wonder Einstein considered compounding the eighth wonder of the world. Even when some people see this laid out for them, simply and sweetly, they can’t quite wrap their head around the elegant math. I hope you can see it. It’s no parlor trick; it’s just math.

Please let me know in the comment section what you think, and your thoughts of using a stock like THW to fulfill your investment requirements to make for a comfortable and reliable retirement.

Should you be interested in getting real time text recommendations like this to your mobile phone and gain access to our exclusive chat forum just for our subscribers, please consider upgrading to a paid subscription today.

Other viral articles readers have found valuable reading with over 70K views, each:

Turn $20,000 in Savings into $1000 a Month in Passive Income

How To Use Dividend Yield as a Reliable Sell (and Buy) Indicator

It’s Not Just What Stocks You Own; It’s Where You Own Them

Potential Recession? Load Up on This Defensive Stock for an 11.5% Yield

Best,

George Schneider, M.A.

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2025, George Schneider

Can we hold this in IRA or 401K? Is this MLP that provides K-1 tax form?