Just Say No to Panic Selling

If you're reading this, you might have sold your stocks in a panic in the most recent market meltdown. You’re just human, after all.

Just Say No to Panic Selling

If you're reading this, you might have sold your stocks in a panic in the most recent market meltdown. You’re just human, after all.

Nearly everyone has a similar reaction to various, specific stimuli in our environment. When a heat wave is upon us, as happened several times already this summer, the common reaction is finding ways to cope; escaping to air-conditioned environs like the public library and hydrating with water to guard against dehydration and its ill effects.

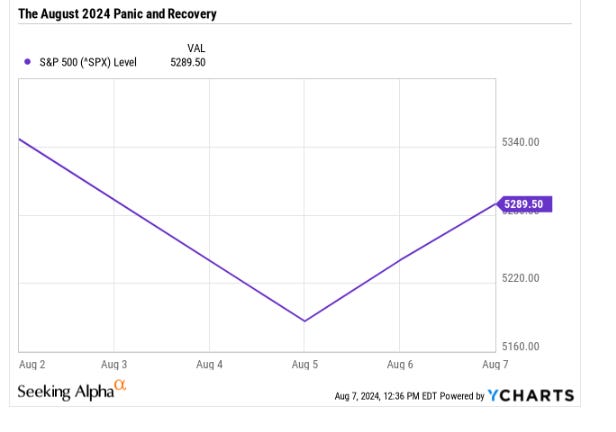

But, when it comes to the volatility of stock market corrections, as when the VIX Index quadruples from 20 to 80 in one trading day, accompanied by a severe drawdown in portfolio values like we experienced in three recent trading days, investors have some pretty distinctive ways of reacting:

1. Fear of losing hard-earned funds.

2. Fear of throwing good money after bad.

3. Panic selling.

4. Taking profits on long-term gains.

5. Buying the dips in order to cost-average losing positions.

Coping Strategies

Of course, if one is a long term investor, far from retirement, the usual successful way to deal with such debacles is to simply ignore them. Stay away from hourly checking of your brokerage account balances and stock market valuations. This is a tried and true method to keep the anxiety away from your doorstep and from stirring the fight or flight mechanism, allowing panic to initiate the intuition to sell.

Advance Preparation

Serious investors make decisions in advance of market meltdowns. Some place sell stop orders for all of their equities to limit their possible losses and preserve their gains, to 15% below current values, or below their purchase price, or below the 52 week highs.

Putting your portfolio on auto-pilot like this can completely vanquish the panic and anxiety associated with high volatility. Knowing that you've preserved the bulk of your capital and have plenty of ammo to fight another day has tremendous advantages.

Just Say No to Panic Selling

Another way to look at this is simply recognizing that panic in the investment sphere is not good for your overall, long-term financial health. In order to conquer this impulse forever, simply let the numbers do the talking, not your emotions. Let your intellectual, rational self take control of your finances, not your emotional self, clouded by fear of loss. To paraphrase Nancy Reagan, just say no to panic selling.

Your Takeaway

Three days after the most recent market meltdown, the markets were posting a furious comeback. Investors who held their positions and resisted the urge to panic had already recovered the greatest part of their paper losses and were on track to setting new highs for this year, yet again.

If you’d like to get my newsletter free in your inbox whenever I publish a new article, just hit the orange “Subscribe” button below.

Best,

George Schneider, M.A.

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2024, George Schneider, M.A