Turn $20,000 in Savings into $1000 a Month in Passive Income

It’s easier than you might think to generate $1,000 a month from just $20,000.

A Warren Buffett investment from 1994 returns 60% each year in dividends. Yes, you read that right. 60% in dividends alone. With enough time and patience, you too can generate that type of return and income from the right type of investments.

Caveat:

There is always this caveat when investing your money:

When investing, your capital is at risk. The value of your investments can go down as well as up and you may get back less than you put in.

That being said, turning $20,000 into $12,000 a year – or $1000 a month – in passive income might seem ambitious. And while it’s not straightforward, it’s absolutely possible in the stock market. It won’t happen overnight. It won’t happen in a week or a month or even in a year’s time. But over a few decades, if you invest in the right type of companies that pay dividends, and raise them every year at a good clip, it is a real possibility.

Owning shares in companies that distribute their earnings as dividends can be a great way to earn extra cash and supplement your monthly Social Security benefit. And one of the best demonstrations of this comes from the famed investor, Warren Buffett.

Warren Buffett and the Coca-Cola Saga

In 1994, Buffett’s investment vehicle, Berkshire Hathaway, owned 400 million shares in Coca-Cola (NYSE:KO), with a market value of $1.3 billion. In 2024, that investment is returning dividends of $776 million (before tax).

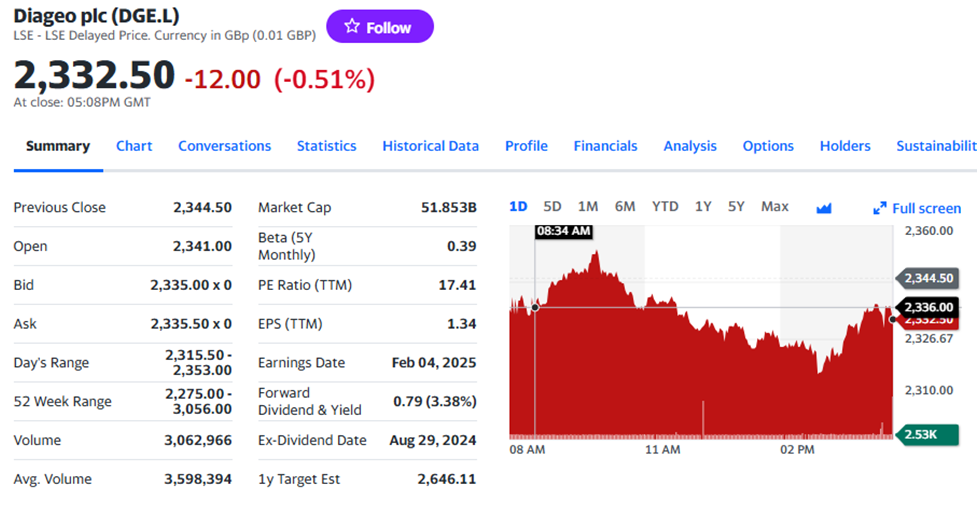

Can Diago (DGE) Do the Same for You?

The amount Buffett receives amounts to 60% of his initial investment in Coke shares.

That’s almost 60% of the cash Buffett initially invested, coming back to him, each and every year. Put another way, it’s the equivalent of earning $12,000 on a $20,000 investment – and the annual distributions just keep growing.

The most impressive thing, in my view, is that Berkshire hasn’t used any of the cash it has received to buy more Coca-Cola shares and increase his income further from that investment. The dividends have gone up by themselves.

Buffett’s a skilled investor, but this particular example’s only partly about that. It’s also about the value of waiting, being patient, and holding on to stocks for the long term.

Can You Discover the Right Stock?

Buffett’s success has been the result of Coca-Cola being able to increase its dividend every year. But investors should note that the rate of growth has slowed over the last 10 years.

Coca-Cola dividends per share 1985-24

Since 2014, the company’s dividend increases have typically been between 2% and 6%. But between 2004 and 2014, they were more in the 7-11% range.

That makes a difference to anyone getting started today. And while I think a lot of investors underestimate Coca-Cola’s prospects, I suspect a return to 10% dividend growth is unlikely.

As a result, I’d look elsewhere for a stock that can increase its dividends for the next 30 years. And the most obvious candidate to me is a constituent of the FTSE 100. That’s the UK’s equivalent of our S&P 500 index.

The Proposition

Diageo (NYSE:DGE) is facing a barrage of challenges at the moment. These include weak macroeconomic conditions in certain markets and the very real possibility of trade tariffs in the US.

Diageo may not be a household name, but if you’ve imbibed any number of alcoholic drinks in your lifetime, you’re probably tasted one or two of their products at the very least.

Diageo plc, together with its subsidiaries, engages in the production, marketing, and sale of alcoholic beverages. The company offers scotch, gin, vodka, rum, raki, liqueur, wine, tequila, Chinese white spirits, cachaça, and brandy, as well as beer, including cider and flavored malt beverages. It also provides Chinese, Canadian, Irish, American, and Indian-Made Foreign Liquor whiskies, as well as flavored malt beverages, ready to drink, and non-alcoholic products.

The company provides its products under the Johnnie Walker, Crown Royal, J&B, Buchanan's, Smirnoff, Cîroc, Ketel One, Captain Morgan, Baileys, Don Julio, Casamigos, Tanqueray, Guinness, Shui Jing Fang, Yenì, McDowell's, Don Papa, Aviation American, Seagram, Seagram's 7 Crown, Zacapa, Black Dog, Black & White, Signature, Royal Challenge, Godawan, Antiquity, Gordon's, Old Parr, Windsor, Bundaberg, Ypióca, Bulleit, and Bell's brand names. It operates in the United States, the United Kingdom, Türkiye, Australia, Korea, India, Greater China, Brazil, Mexico, South Africa, Nigeria, and internationally. The company was incorporated in 1886 and is headquartered in London, the United Kingdom.

As a result of macroeconomic challenges, the stock’s trading with an unusually high dividend yield. For the first time since around 2015, investors who buy the stock today start with a 3.38% return.

Diageo Dividend Yield 2014-24

From there, it’s about growth – to match Buffett’s result, Diageo’s dividend needs to grow by 10% a year for 30 years. That’s a big ask, but the company’s in a strong competitive position.

Consumer tastes might evolve, but Diageo’s scale means it can make acquisitions to stay on trend. That’s been the key to its success so far and I think it looks like a durable advantage.

Dividend Growth

As Buffett says, the best companies are ones that can increase their earnings – and dividends – without needing more cash. Coca-Cola’s a great example.

Your Takeaway

I think Diageo’s a similar type of business. And with the stock unusually cheap, on sale, 25% off its 52 week high, we’ll be positioning our portfolio for a good entry point and starting position in this stock.

When the full picture of Trump’s tariffs comes into view several weeks from now, a high-enough tariff could be the catalyst for a further sell-off, making a portfolio acquisition in this name a better bet at an even better starting yield.

Other articles readers have found valuable reading:

How To Use Dividend Yield as a Reliable Sell (and Buy)Indicator

It’s Not Just What Stocks You Own; It’s Where You Own Them

Potential Recession? Load Up on This Defensive Stock for an 11.5% Yield

Best,

George Schneider

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2024, George Schneider

Allan, thanks for liking this post.