When the King Declares a Trade War, Cash is King

A good cash reserve can guard against disaster in a bear market.

source: created by author with Bing Image Creator

This could be you. I know, I know. During these trying times, it’s hard to imagine yourself smiling and holding a bucket overflowing with cash as you witness your stock holdings melt down, day after relentless day.

But the absolute truth is that if you simply bulk up your cash and cash-like holdings in order to ride out storms like the current crash, the psychological benefit is so huge that it is possible to cancel out the angst from a stock crash. The peace of mind that cash buys is priceless.

Let Me Demonstrate

If you held 100% of your investable assets in stocks that mirrored the S&P 500 index, over the last several months you saw your overall portfolio value decline by 15%.

If your original portfolio value before the decline was $500,000.00 for example, your portfolio lost $75,000.00 over this time period.

Cash is King

On the other hand, if you had set aside 40% of your investable assets in high yield savings accounts yielding 5% in order to shield your portfolio from volatility, or extraordinary circumstances of a president unilaterally imposing large tariffs on trade partners, friend and foe alike, here’s how your portfolio would have fared, instead:

60% of your portfolio, or $300,000.00 invested in an S&P ETF:

$300,000.00 X .15 = $45,000.00 decline in value

40% of your portfolio, or $200,000.00 invested in a 5% yielding online savings account:

$200,000,00 X.05 =$10,000.00 annual increase (bank interest)

Net Calculation:

$45,000 decline in value + $10,000 increase in value = -$35,000

In the first scenario where you are 100% invested in the market, your loss would have come to $75,000.

In the second scenario, where you would have hedged 40% of your portfolio in cash, your loss would have been just $35,000.

It becomes clear now that hedging a decent part of your portfolio to guard against black swans such as the current ongoing trade war would have saved you $40,000, and your net loss for the year would be just 7.0%. That’s less than half the 15% loss suffered in the all stock portfolio.

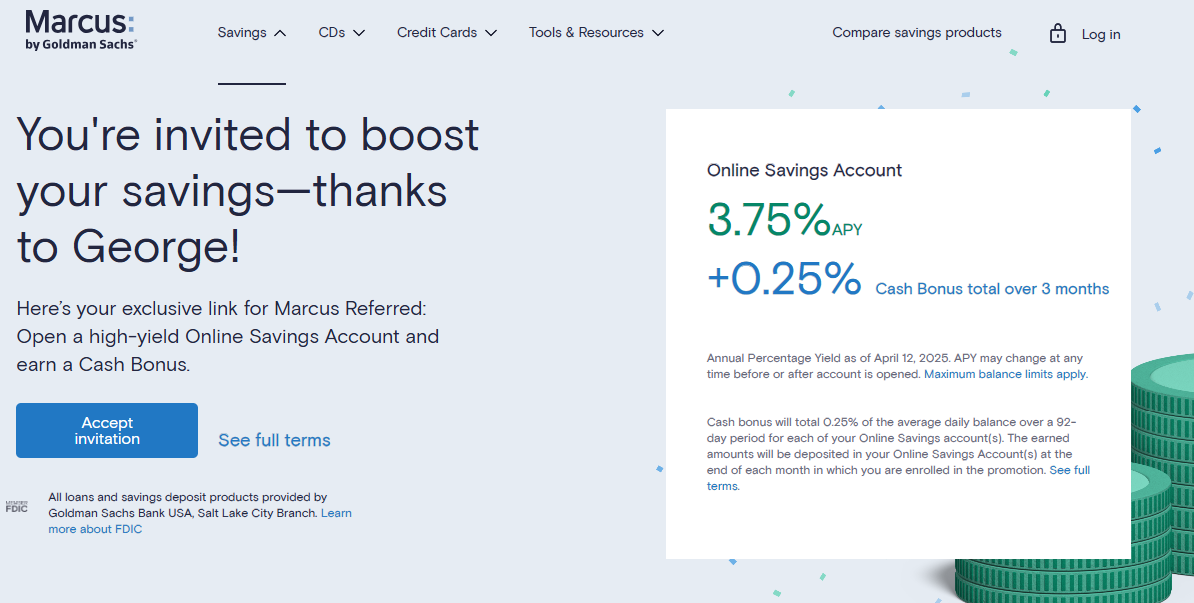

Grab yourself some peace of mind and start building your cash reserve today for an excellent hedge against the stock market and a great, FDIC-insured monthly income.

Use this special referral code and you’ll earn 8X the national average, plus a 1% bonus plus a .1% additional bonus if you’re an AARP member. This is a high-yield savings account offered by one of the biggest, most respected, FDIC insured banks in the world, Marcus by Goldman Sachs.

Your Takeaway

Utilizing this model in your portfolio, you don’t have to worry so much about what could come out of the blue and kill your portfolio. Having a good cash cushion not only safeguards a good amount of your savings from unexpected surprises, it also renders your psyche safe from anxiety and allows you to know that 40% of your assets will continue generating good income. You’ll never have the knee-jerk panicked-urge to sell your shares at the lows due to anxiety about what could happen next.

This ongoing source of FDIC-insured income gives you the income you need to pay the bills and gives you peace of mind as it cushions your portfolio from out-sized losses. Peace of mind is truly priceless at times like these.

After President Trump paused the reciprocal tariffs on Wednesday, hope sprang eternal, with the S&P 500 closing up 9.52%. Thursday, the market remembered, oops, those 10% tariffs are still in place and represent a huge tax increase for business and consumers. The market promptly went back into the tank, down 5.5% in the early morning hours. This ongoing roller coaster does not help consumer, investor or business confidence.

If the remaining 10% tariffs can be rolled back with all of our trading partners, President Trump will be able to declare victory and the markets, worldwide, will breathe a welcome sigh of relief. Then he could begin negotiations in earnest with China to remove the 145% in tariffs he’s imposed. Next up could be Canada and Mexico, to remove the 25% tariffs he’s imposed on automobile imports. Markets want nothing more than a return to normalcy. Investors want a return to business as usual, just assessing fundamentals, including company profits, sales and earnings and making prognostications on those alone.

Subscribers to the Retirement: One Dividend At A Time investment newsletter who mirror the RODAT Portfolio have annual income in excess of $138,000.00 from dividends alone.

I don’t have investors or work for a large corporation. My work is fueled by people like you. If you enjoyed this article, would you consider supporting me?

Other articles with over 80,000 views each that readers found worthwhile reading:

Turn $20,000 in Savings into $1000 a Month in Passive Income

It’s easier than you might think to generate $1,000 a month from just $20,000.medium.com

Here’s What Warren Buffett is Doing as the US Stock Market Plunges

Buffett’s actions may seem counter-intuitive to new investors: More experienced investors get itmedium.com

Eroxon Beats Viagra Hands Down

Beating off and intimate sex has just gotten way easier and faster.medium.com

Stocks Threatened with Administration’s Demolition

A demolition derby may be approaching; sell, sell, sell!medium.com

Get Rich as Your Portfolio Collapses

Losing money is the quickest way to earn riches.medium.com

The Coming Bear Market/Recession Can Save Your Retirement

All it takes is a life-changing shift of perspective to understand: A bear market and a recession could save your…medium.com

Best,

George Schneider, M.A.

Founder and publisher

Retirement: One Dividend At A Time

Disclaimer: This article is intended to provide information to interested parties. As I have no knowledge of individual investor circumstances, goals, and/or portfolio concentration or diversification, readers are expected to complete their own due diligence before purchasing any stocks mentioned or recommended.

Disclosure: I am long all RODAT Portfolio names. The Portfolio continues to build dividend income with reliable, dependable equities which have long histories of increasing the dividend.

Copyright ©2025, George Schneider, M.A.